The Role of Skill & Breadth in Quant Investing

We explore one of the key concepts within active portfolio management built around investor skill and the number of bets they take.

“The first necessary ingredient for success in active management is a recognition of the challenge. On this issue, financial economists and quantitative researchers fall into three categories: those who think successful active management is impossible, those who think it is easy, and those who think it is difficult.”

Grinold and Kahn

Most investors are aware that securities prices are hard to predict (if it were easy, we’d all be on a beach).

This extreme difficulty is due to the complex interactions between the vast number of investors each day, who as market participants, push prices either up or down through their purchases and sales (influenced by countless factors).

The result is a securities price that looks, and behaves, quite randomly.

Almost like a coin toss.

A Random Walk

This phenomenon has been known for quite a long time.

The first formulation of the securities’ price as a mathematical model was done by Louis Bachelier in 1900 with his work "The Theory of Speculation.”

Louis noticed that if you ignore, for simplicity, the general trend of securities prices in a market to appreciate over longer periods, you could essentially model a securities price change as analogous to a coin toss, where if the coin lands on heads the price goes up, and if the coin lands on tails, the price goes down.

Therefore, we can describe mathematically the price chart as following what was deemed “a random walk,” where the price today is equal to the price yesterday plus some random, unpredictable, fluctuation:

The reason for introducing the random walk will become apparent in the next few sections, where we discuss the role that breadth and skill play in quantitative investing.

The Roulette Wheel

Suppose that you run a casino, and the only game you offer is a single Roulette wheel.

In American Roulette, there are 18 red numbers, 18 black numbers, and two green numbers 0 and 00 (for a total of 38 slots on the wheel).

The green slots on the wheel represent the Casino’s skill (otherwise known as “house edge,”) and we will subsequently show how this plays a role in the amount of money the casino makes, as well as how variable this skill payment (or risk premium) is over time.

Now imagine that a player decides to bet on red.

We can use the random walk model above to model their bankroll if we replace the price P_t above with B_t the initial funds the player has to start with.

Each time the player wins, their bankroll becomes B_t = B_t-1 + b_t where b_t is their bet, and likewise, their bankroll is B_t = B_t-1 - b_t if they lose.

Note that the probability of the player winning is 18/38=0.4737 or roughly 47%, which is less than 50%. This means the casino’s probability of winning is 100%-47%=53%.

In this case, we can think of the casino’s skill as the amount that their probability of winning exceeds 50%, so they have 3% skill.

Below we chart an example of a single player’s bankroll B_t if they play 30 games, each time betting $1 on either red or black, where they start with an initial bankroll of $10. Notice in this case the player made money.

Does this mean the player has skill? Or could it just have been pure luck?

The Role of Skill & Breadth

The fact is that the player was just lucky this time. Why is this a fact? This is because of something called the Law of Large Numbers.

What this statistical law says is that as we increase the number of a series of random outcomes, the sum (or average) of these outcomes will eventually converge to the “true probability.”

We know that the true probability of the player winning is only 47%.

This time the player got lucky, but if the player were to play a very large number of times, they would lose more times than they won.

If you then counted up how many times they won, over this very large amount of time, it should converge on 47%.

Since the bankroll is just the sum of all the individual outcomes we should find that the player walks away from the table with less than they started with 47% of the time.

On the flipside, that means the casino is making money off of a given player 53% of the time.

And the more that player plays, the more consistently (i.e. less variably) this is true.

Moreover, it becomes even more true, in aggregate, as different individual players play at the roulette table simultaneously.

For very few bets, given a single player, and if you didn’t know the system was rigged, you might think the Casino didn’t have skill at all, since as we saw above, the single player over a short period won $7.

But given many players, all playing a lot, on aggregate, they lose.

In essence, the more bets are taken, the more the Casino can manifest their skill.

And this manifestation of their skill is expedited through the number of individual bets taken.

This measure of the number of individual bets taken is called breadth.

The Fundamental Law of Active Management

So what does the Casino’s skill have to do with quantitative investing? It turns out, quite a lot.

Returning to the example of a security’s price following a random walk, we can now investigate a single investor who can potentially bet on many securities in a market.

Let’s suppose the investor believes they have skill at security picking.

Using what we learned above, it becomes clear that to truly validate their skill, the investor shouldn’t just invest in one security and wait and see what happens over a long period; rather the investor should invest in many securities, and preferably securities where their price movements are relatively uncorrelated with each other.

They should also rebalance their portfolios frequently, to make new bets, responding to new information as it becomes available.1

Moreover, it turns out that there’s a relationship between the amount of uncorrelated bets taken (i.e. a portfolio’s breadth) and the investors’ skill, and how these two measures interact in determining portfolio performance.

It’s called the Fundamental Law of Active Management, discussed by Grinold & Kahn in their 1995 book “Active Portfolio Management.”

Most investors are familiar with the common measure of performance, the Sharpe Ratio.

The Sharpe Ratio measures the portfolios’ return, relative to the portfolio's volatility. In essence, it’s a measure of return per unit of risk.

The Sharpe Ratio (SR hereon) is defined as the average return divided by the standard deviation of returns.

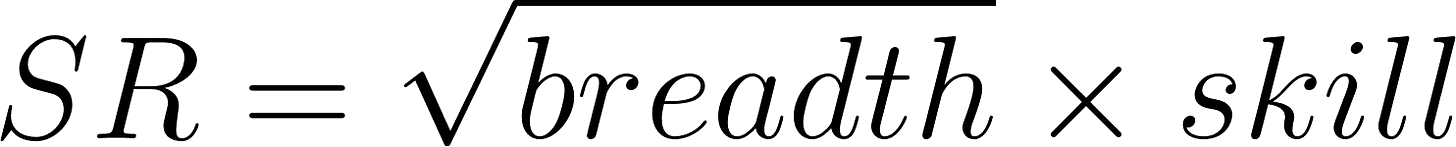

The Fundamental Law of Active Management says that the SR is related to skill and breadth as follows:

This means that for a given level of breadth, the SR can be increased linearly by increasing skill at picking securities.

And vice versa, for a given level of skill, the SR can be increased by increasing breadth, but this gain is incrementally smaller as breadth increases, because of the square root.

An investor with a very high amount of skill could get away with low breadth and still exhibit good performance, but in reality, most investors have very low skill because of how inherently random securities prices are.

The implications of the formula above are quite interesting.

For one, it means that investors with even very little skill can improve their portfolio performance by increasing their breadth, if breadth is low to begin with.

In essence, this is the same as what the Casino example above illustrated: the Casino’s skill was 3%; when only one player played Roulette the Casino’s SR was quite variable and in our example was negative!2

But as more players bet and the Casino is more accurately able to express its skill, the SR will inevitably rise.

And, for very small levels of skill, and a large amount of breadth, the SR of the Casino’s portfolio can become very impressive indeed.

In Conclusion

At AlphaLayer, the Fundamental Law of Active Management is a core component of our thinking in the strategies we develop. We look at where we have skill, how it can be increased, and how it can be spread across a large number of bets.

All to deliver more casino-like returns in our strategies.

It’s worth noting that validating an investor’s skill and the practical considerations of investing can be at odds with each other. In this case, trading frequently can induce commissions or other transaction costs which can be a drag on a portfolio’s performance. For this discussion, we ignore these more practical considerations.

The astute reader might wonder how it can be that the SR can be negative if both breadth and skill, albeit low, were positive in the Casino example. This is because there’s a difference between the small sample estimates of the SR and the population value based on a large sample.